AI Policing: Personalized Advice and Safety Checks for AI Investing

Telescope AI, the fintech startup bringing AI-powered investment idea generation to the asset management industry, today announced the launch of two new safety and compliance features on their flagship product, Ripple.

With the latest product update, Ripple users will now have access to “Personalized Advice” checks and “Safety Checks” on every investment basket prompt submitted to the platform. According to Telescope founder Luc Pettett, these new capabilities leverage the natural language understanding of large language models to ensure legal and ethical compliance.

”Safety and legal frameworks are paramount to our platform. What’s interesting is the same technology that brings you rational portfolio construction with AI can also bring you rational legal frameworks with AI - we actually pass in snippets of legal text to have our AI make a decision on what may or may not be considered appropriate” said Pettett.

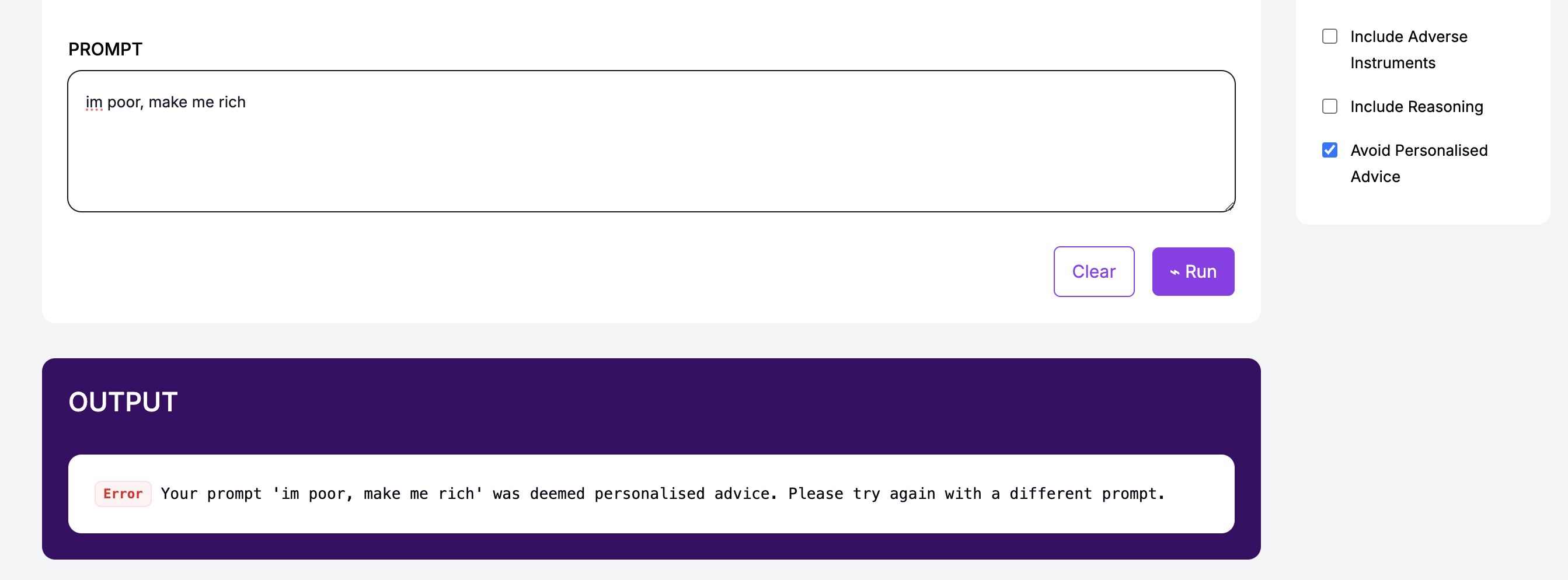

The “Personalized Advice” feature automatically detects if a prompt constitutes personalized financial advice, which would be prohibited under certain regulations. For example, a prompt like “I’m poor, make me rich” would be flagged as inappropriate. On the other hand, an investment theme prompt like “ageing population” would be permitted. While not offering direct legal guidance, this feature manages regulatory risk by rejecting non-compliant prompts.

The need for personalized advice checks with AI is becoming increasingly important as the technology advances. While AI can provide generalized advice and a list of stocks, it crosses a line when making specific recommendations tailored to an individual’s financial situation. Prompts that include personal details like “I own shares of company X, what should I buy next?” could lead the AI to generate biased and unsuitable advice. As Pettett explains, Telescope’s personalized advice officer acts as a safeguard against this by screening for any personalized prompts. It understands relevant regulations and compliance guidelines to determine if a prompt aims to elicit personalized guidance versus broadly applicable investment themes suitable for generating AI-powered baskets. Considerations around responsible and ethical AI development are crucial as these systems become more sophisticated. Telescope’s proactive approach aims to prevent misuse while allowing clients full access to the technology’s capabilities.

Failed due to personalized advice checks.

Failed due to personalized advice checks.

Meanwhile, the “Safety Checks” feature leverages AI content moderation to screen prompts for any inappropriate or unethical concepts such as investing across themes linked to hate, racism, violence, self-harm and sex portrayed in certain ways. This prevents the generation of any concerning investment baskets and ensures Ripple promotes responsible, values-aligned investing.

According to Pettett, these enhancements demonstrate Telescope’s commitment to developing a robust ethics-based framework alongside cutting-edge AI capabilities. As the technology continues to advance at a rapid pace, considerations around safety, transparency, and fair access will only grow in importance.

”We’re thrilled to be integrating state-of-the-art AI into the investment process in an ethical, compliant way,” said Pettett. “As we iterate based on customer feedback, we’ll continue translating the latest AI breakthroughs into real-world value while prioritizing safety.”

With the new safety and compliance features, Telescope aims to further cement its position as a leader in AI-augmented investing. The company plans to build a platform that can navigate all of the risks and opportunities when it comes to these powerful new AI enabled technologies, which includes a robust understanding of the regulations and our responsiblities to investors.