New Support for ETF Discovery on Telescope's Ripple

Today we’re introducing Telescope’s powerful AI engine Ripple with added capability to discover relevant ETFs based on any desired investing theme or scenario. This new model upgrade will investing platforms and their investors, along with wealth managers to instantly identify ETFs poised to benefit from major trends and events. With over 3,200 ETFs now available in the US alone, Ripple’s AI-powered search helps investors quickly uncover options matching their desired thesis for almost any scenario or event, fact or fiction.

Megatrends like shifts in global supply chains, demographic changes, or technology disruptions impact entire sectors and geographies in complex ways. For an investor and for AI, identifying a handful of stocks poised to benefit becomes an incomplete and challenging task. However, broad ETFs tracking regional, sector and factor indexes can provide targeted exposure to broader macro-style trends. Exchange-traded funds (ETFs) have exploded in popularity in recent years as a way for investors to gain broad market exposure or target specific sectors and themes.

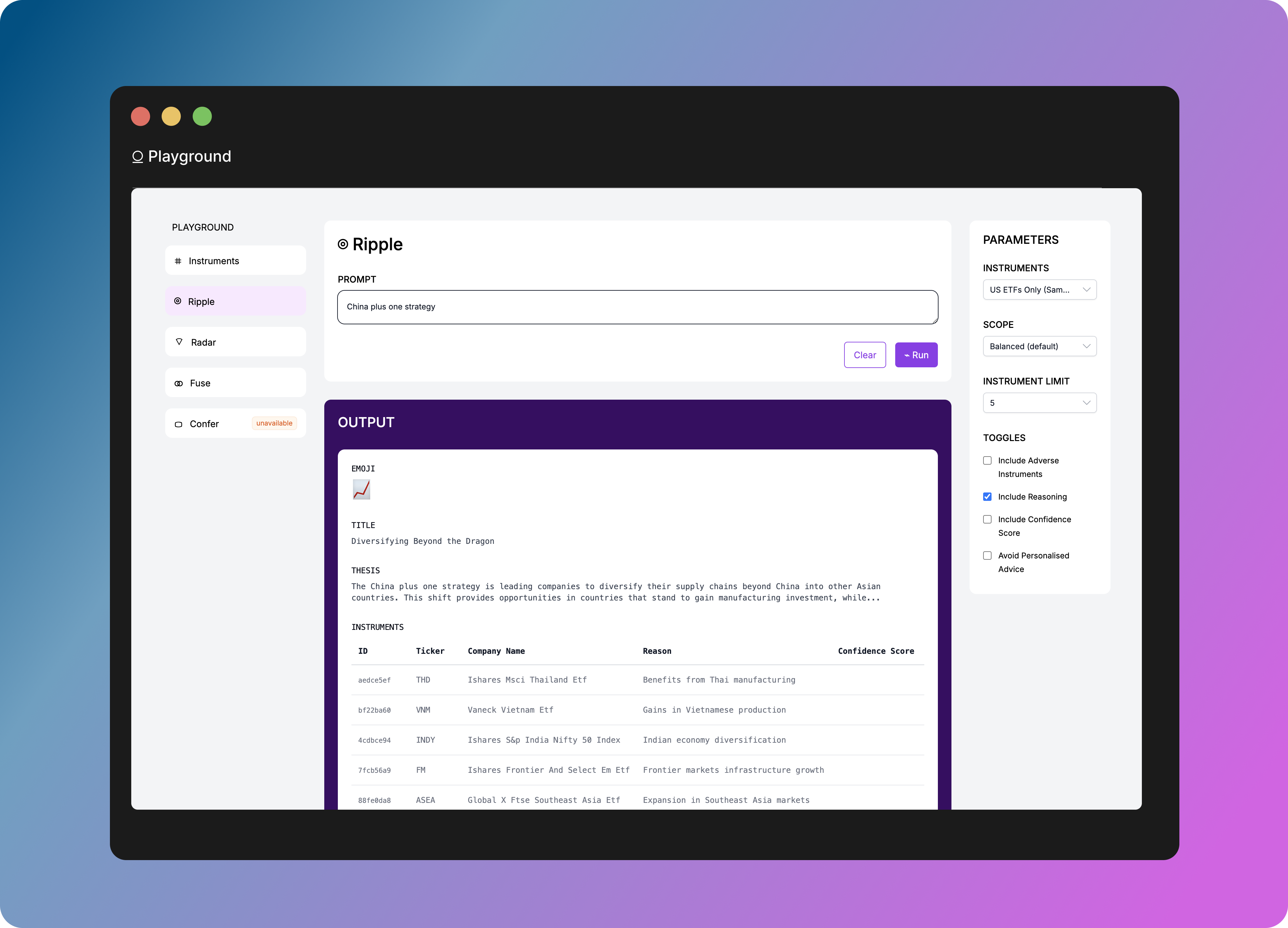

For example, prompting Ripple with “China plus one strategy” will return ETFs that provide exposure to manufacturing and supply chain companies based outside of China. This theme is difficult to capture with individual stock picking, but broad ETFs tracking geographic and sector indexes can provide targeted exposure. With over 3,200 ETFs now available in the US alone, Ripple’s AI-powered search helps investors quickly uncover options matching their desired thesis.

In this example, Ripple may consider known trends such as energy costs, logistics, education rates, aging population dynamics, manufacturing capacity and highlight available in locations like India, Thailand, South Korea, Vietnam, Mexico, and Malaysia.

Prompt: “china plus one strategy”

Prompt: “china plus one strategy”

The rise of passive-hold broker apps who specifically focus on ETF ownership will be able to leverage the Telescope technology, allowing us to better serve those customers.

”Native support for ETFs, using instrument data supplied directly to us by our clients greatly expands the breadth of investments our models can work off. This feature surprised us, providing a more meaningful experience than we expected.”, Luc Pettett, Founder.

Pettett adds, “Initially we thought the use-case for this feature was to simply help solve megatrend investment discover however we’ve found this feature useful for even the simplest requests; For example the prompt: ‘dividends’ will result in probabilistically lead suggestions of which ETFs to consider (lowest fees, largest FUM etc.), rather than relying on Google or an ETF website to narrow down your decision.

Under the hood, Ripple relies on Telescope’s foundation of large language models fine-tuned on financial texts and data using datasets with many billions of parameters. These models have learned nuanced knowledge about market sectors, macroeconomics, and the competitive landscape across industries. This allows Ripple to make intelligent associations between a prompted theme and the most relevant ETFs.

Beyond the ETF suggestions, Ripple also generates an investment thesis explaining why each ETF is poised to benefit. This provides context into the reasoning behind the recommendations.

As with all Telescope products, Ripple is designed to enhance human capabilities, not replace them. Ripple and this model upgrade is fully supported alongside our existing safety checks and personalized advice guidelines. AI simply accelerates the initial search process to filter ETFs warranting further evaluation by an investor. Human judgement is still essential to assess the suggested opportunities and construct a portfolio aligned with an individual’s strategy and risk preferences.

Going forward, we plan to continue expanding Ripple’s capabilities and knowledge. Adding support for mutual funds, commodities, and foreign exchange markets are areas of exploration. We also aim to refine Ripple’s reasoning abilities so it can explain connections and recommendations even more clearly.

The addition of ETF discovery furthers Ripple’s goal of making AI a partner for intelligent investing and is generally available to all Telescope customers.

We’re excited to get these new capabilities in the hands of investors, finance platforms and fund managers to help unlock better investment outcomes. Please get in touch to learn more or request a demo.