Telescope AI launches Echo: Real-time filing analysis

Today, we’re excited to introduce Echo, our latest API service designed to reshape financial news and analysis.

Powered by Telescope’s proprietary Knowledge-Enhanced LLM architecture (KE-LLM), Echo processes complex financial documents, gathering the latest business metrics and operational insights, ranking them by relevance and producing detailed articles and summaries in minutes.

Echo Capabilities: Scalable instant insights across all exchanges

Echo processes SEC filings with institutional-grade accuracy at machine speed. Key performance metrics:

- Processing time: 2-10 minutes for comprehensive analysis

- Interpretation of charts, graphs, technical diagrams, and complex data visualizations

- Multi-format analysis supporting tables, heat maps, geological data, and industry-specific technical artifacts

- Output formats: Markdown

- Language support: 20+ languages with semantic preservation

- Coverage: All US-listed securities and SEC filers

- Document types: 10-K, 10-Q, 8-K, and supplementary materials

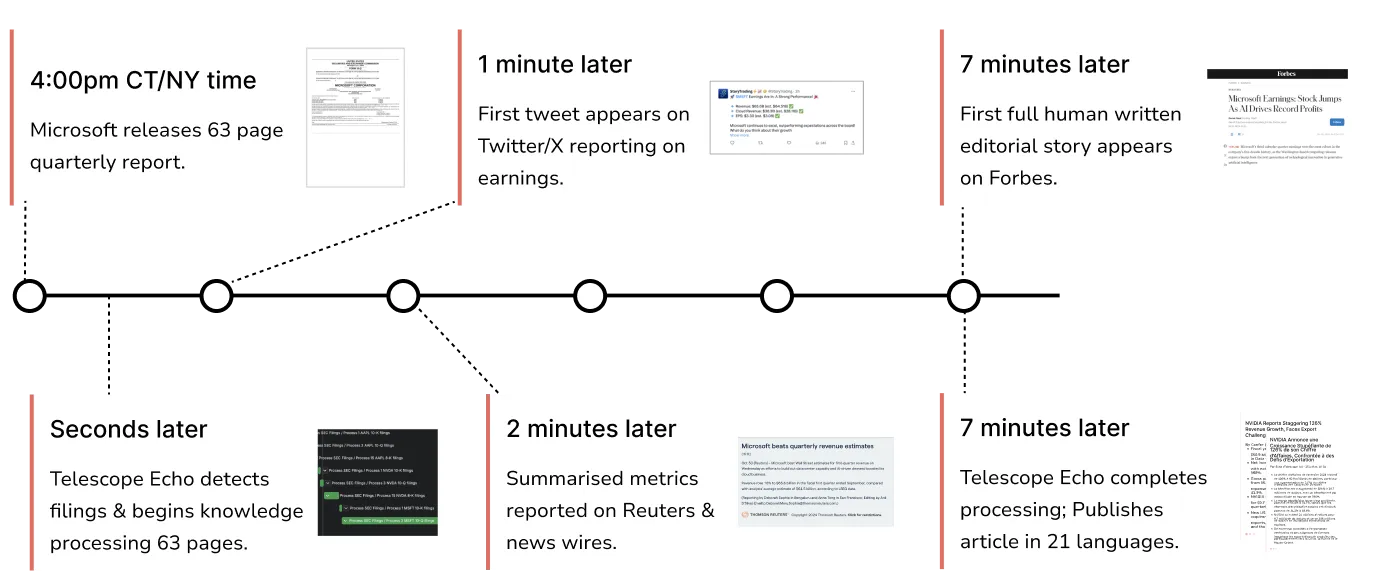

A recent comparison using Microsoft’s Q3 2024 earnings release, Echo processed the 63-page document in 7 minutes, generating analysis in 21 languages simultaneously. The output matched the depth of major financial publications while maintaining strict quality requirements.

Echo’s parallel processing architecture enables it to analyze the entire daily SEC filing volume.

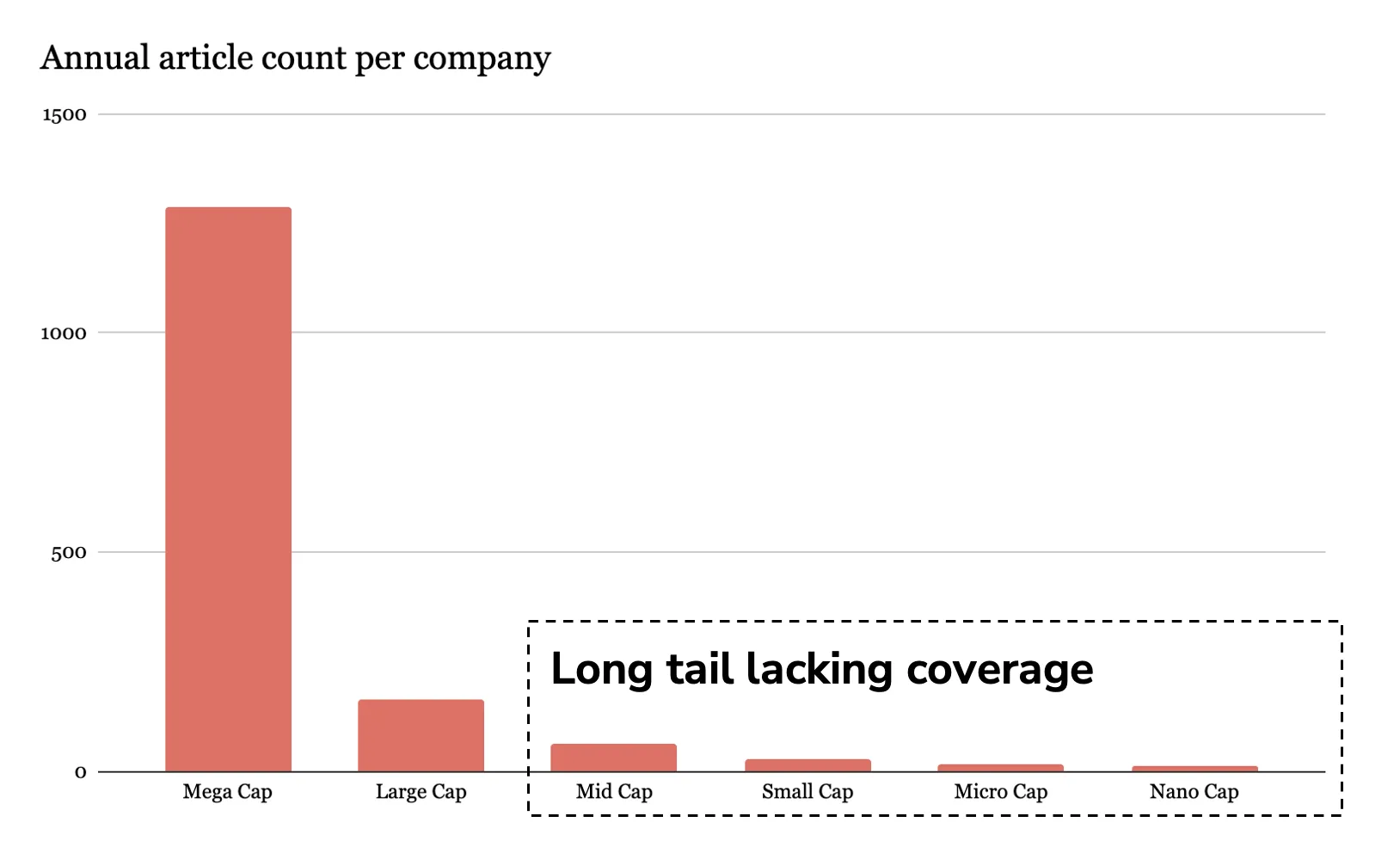

Addressing the coverage gap

SEC filings analysis reveals a significant information asymmetry across market capitalizations. Our analysis of media coverage across 5,000+ US-listed companies shows dramatic disparities in information distribution:

Key findings from the coverage analysis:

- Mega-cap companies receive 63.9x more media coverage than small, micro, and nano-cap companies combined

- 66.1% of US-listed companies (predominantly small to mid-cap) receive only 15% of total market coverage

- The bottom three market cap segments average fewer than 50 articles per company annually

- Mega-caps average 1,250+ articles per company annually, led by Nvidia with 7000+ articles per year.

Echo addresses this market inefficiency by providing consistent coverage across all market segments. The system processes every SEC filing with the same depth and rigor, regardless of company size or media attention. This democratization of financial analysis helps investors and stakeholders access institutional-grade insights for previously underserved segments of the market.

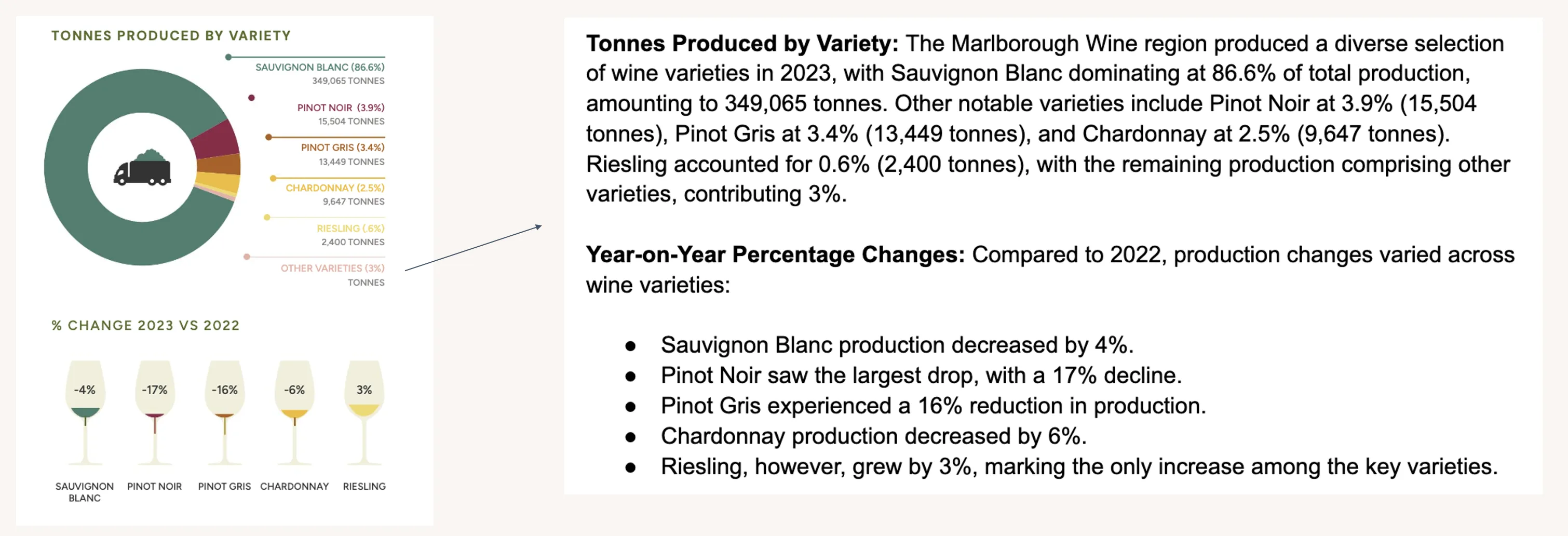

Echo Capabilities: Interpreting industry-specific artifacts

Echo excels in analyzing visual artifacts within financial documents - a critical capability since crucial information in filings often exists only in images, charts, and technical diagrams.

Consider a recent analysis of a wine production report (shown above). Echo accurately extracted and interpreted the donut chart data, identifying Sauvignon Blanc’s 86.6% production share (349,065 tonnes) and precisely tracking year-over-year changes across varietals through the wine glass visualization.

This same capability extends to complex technical documents across industries:

- Mining and Resources: Geological cross-sections and drill core results, Heat maps of mineral deposits, Site development plans and staging diagrams, Production zone maps with grade distributions

- Real Estate Development: Property portfolio heat maps, Occupancy rate visualizations, Development pipeline timelines, Geographic distribution charts

- Engineering and Manufacturing: Technical drawings and schematics, Production line efficiency charts, Quality control visualizations, Capacity utilization diagrams.

- Biotech and Pharmaceuticals: Clinical trial result visualizations, Patient response curves, Molecular structure diagrams, Drug efficacy comparisons, Safety data heat maps

This visual interpretation capability is particularly valuable since analysts often rely heavily on these technical images to form their assessments. While traditional text-based analysis misses this critical information, Echo processes both textual and visual data to provide comprehensive insights.

Looking ahead: trader implications

As this knowledge base is extended and our products expand, consider the trade opportunities an investor may unlock. When an earthquake affects a specific region, you could instantly assess damage zone maps against REIT property distributions. When a mining company releases adjacent drill results, investors can analyze geological cross-sections to evaluate implications for neighboring claims. During biotech catalyst events, investors can interpret clinical trial data visualizations within minutes of release, spotting subtle patterns in patient response curves or safety signals that could influence market reactions.

This speed and precision in combining a robust understanding of a knowledge source with LLMs – traditionally requiring hours of expert analysis – creates opportunities for more informed and timely investment decisions across multiple sectors. The benefit extends beyond traders to stakeholders, investor relations and the companies themselves.

Looking ahead: roadmap

Echo’s immediate roadmap focuses on core processing capabilities: expanding coverage to major global exchanges, growing our language support to 40+ languages by Q1 2025, and enhancing our KE-LLM engine to process an even broader range of financial documents and data structures with greater precision.

Building on this foundation, we’re developing features that leverage Echo’s knowledge processing capabilities in new ways: custom article templates for specialized reporting needs, long-form synthesis across multiple filings and time periods, benchmarking on the platform’s capabilities and conversational agents that can engage with Echo’s processed insights. These additions will transform how teams interact with and extract value from financial documents, while maintaining the same rigor and traceability that Echo delivers today.