The Agentic Advantage

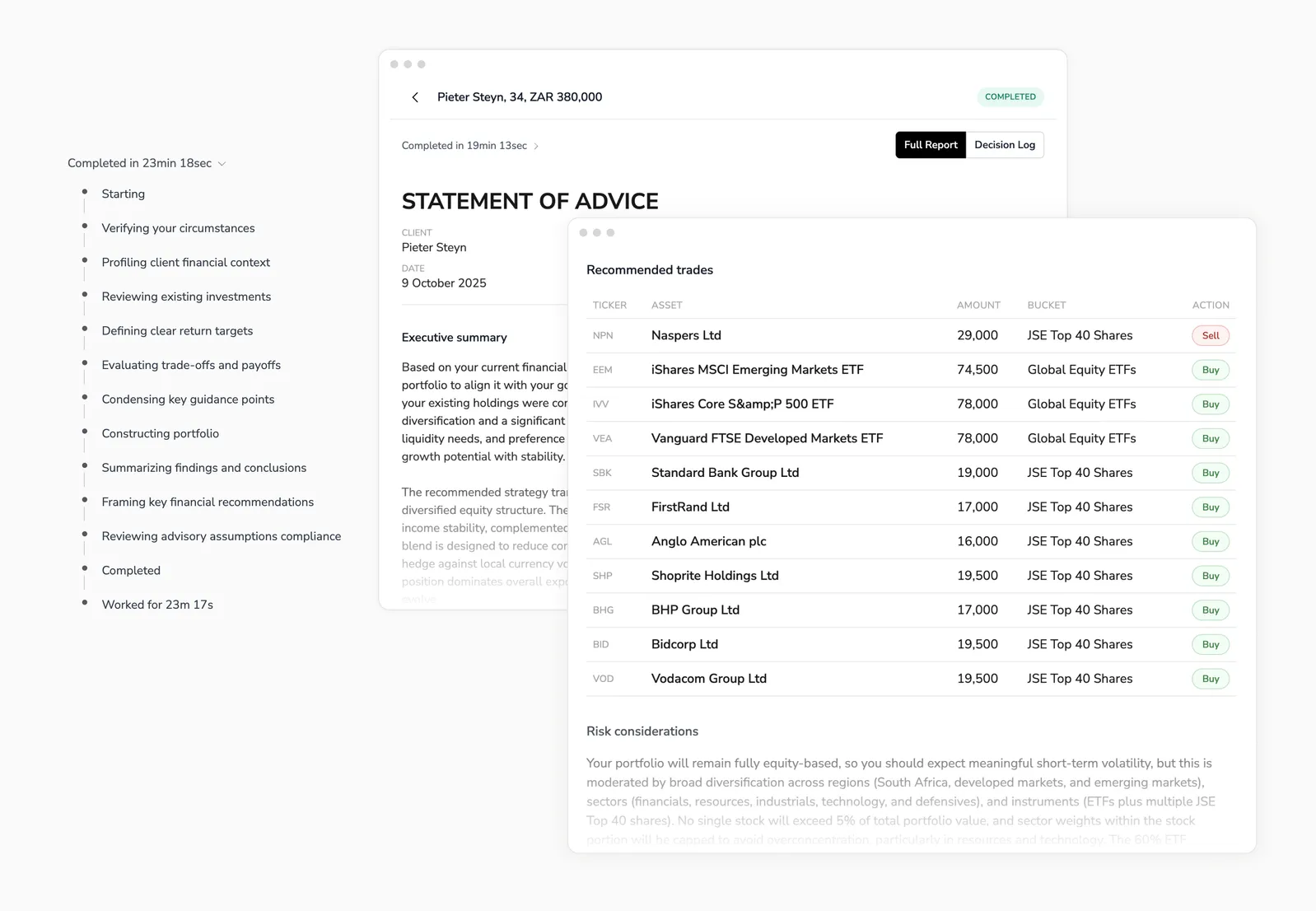

- Executes hundreds of iterative reasoning steps for every client scenario

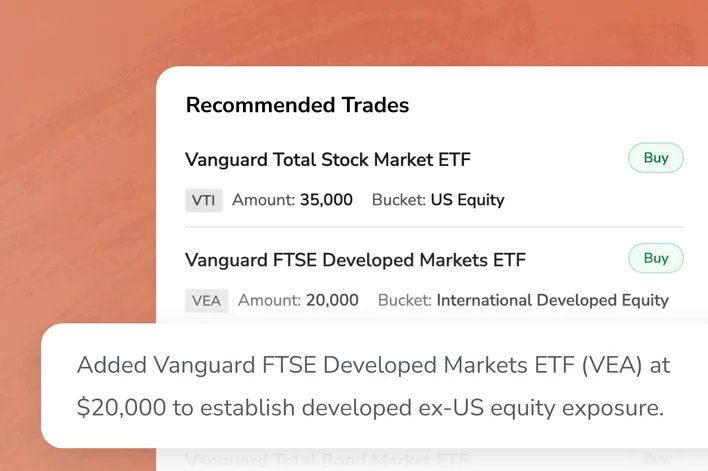

- Builds a complete narrative around needs, risks, allocation, and execution

- Produces draft Statements of Advice within minutes instead of days

An agentic research platform exploring AI-powered financial advice across every major market.

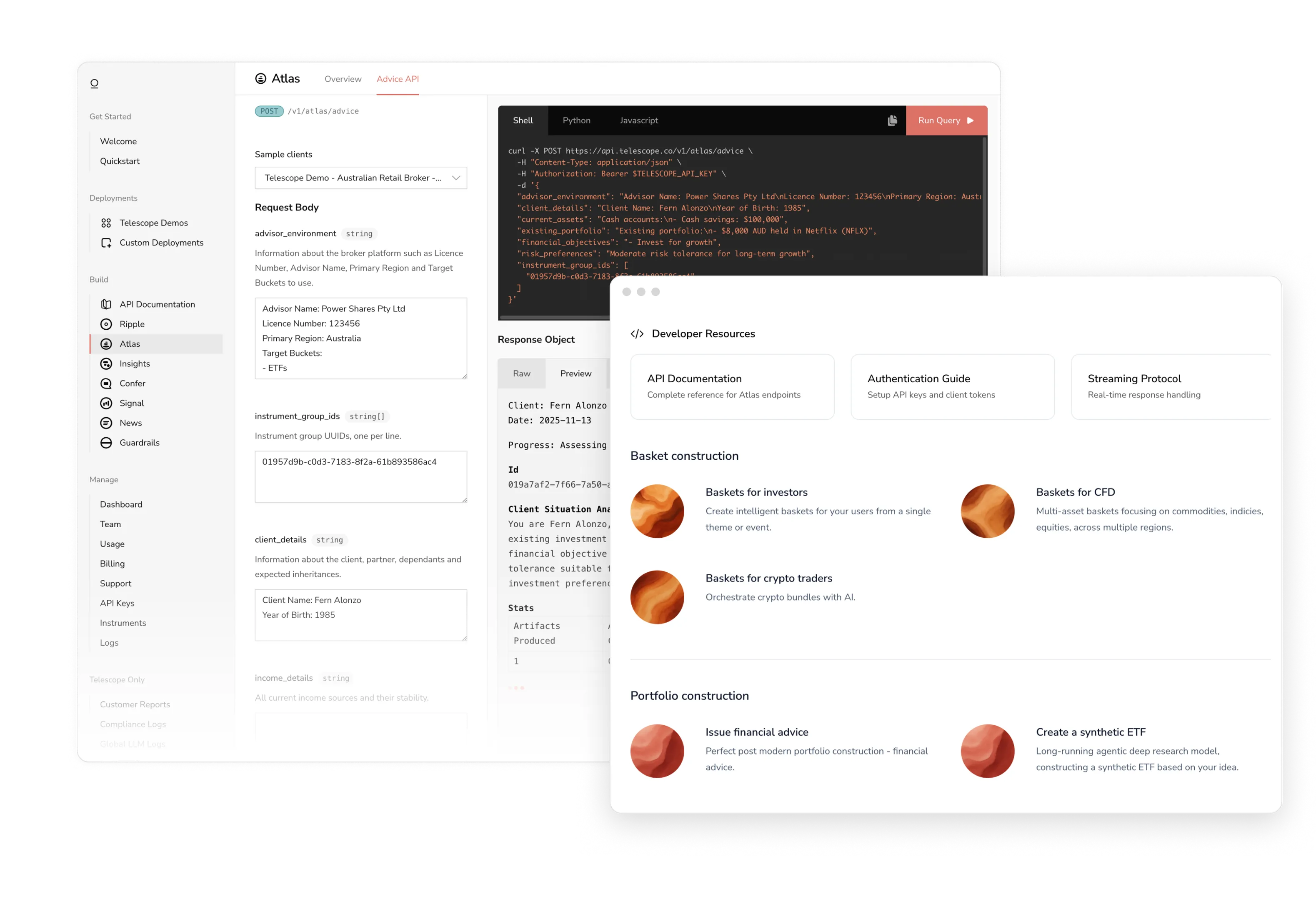

Atlas executes hundreds of agentic reasoning cycles to produce draft Statements of Advice that reflect client goals, constraints, and the guardrails you define—delivering complete narratives in minutes instead of days.

Stays within the facts provided, highlighting missing information instead of fabricating data. Atlas doesn't drift based on short-term trends or personal bias, ensuring consistent, objective recommendations every time.

Configure the exchanges, asset classes, house views, and firm-specific rules that Atlas should follow—from minimum trade sizing to portfolio rounding policies—so it reasons within your operating model.

Partner with Telescope to explore compliant, AI-assisted financial advice.

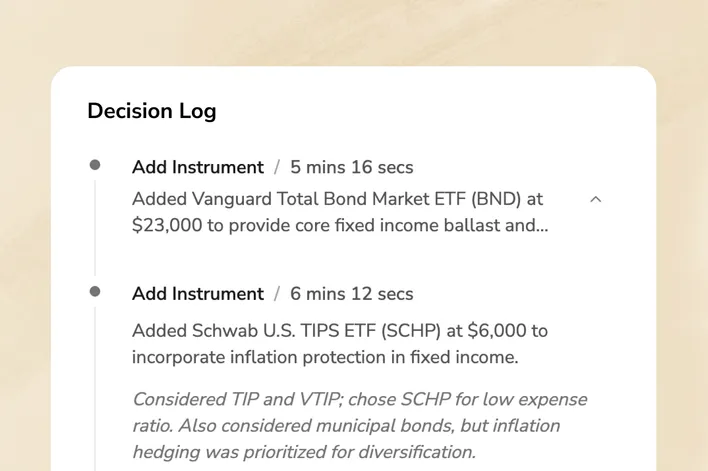

Built for transparent, high-quality advice. Atlas mirrors the reasoning journey of human advisors while documenting every decision it makes.

We're constantly evolving how Atlas approaches financial guidance, keeping our technology ahead of regulatory expectations and industry standards.

By partnering with licensed financial services firms to validate workflows, gather regulator feedback, and refine guardrails for jurisdiction-specific requirements, we ensure our agentic advice capabilities meet modern compliance frameworks while delivering transparent, high-quality recommendations.

Read the letter →

Every firm has unique advice workflows and compliance requirements. Let's discuss yours.

Request a demo →Get access to Atlas on our dedicated platform environment, including custom deployments.

Request a demo →

Your data remains yours. DPAs across every frontier provider, optional self-hosting, and real-time logging guarantee transparency.

We collaborate with your compliance officers, providing production monitoring, detailed reporting, and configurable guardrails.

A dedicated research team continuously evaluates model behavior and performance, running proprietary benchmarks before deployment.

Every integration undergoes extensive testing so orchestration is stable, auditable, and ready for global financial workloads.

Tier 1 institutions rely on Telescope worldwide. Redundant models, comprehensive logging, and hardened infrastructure keep deployments online.

Custom deployments adapt to your workflows. Documentation, dedicated design support, and rapid prototyping accelerate time-to-value.

Atlas is under development and not yet available for deployment to end clients. Telescope partners with licensed financial services organisations to navigate regulatory pathways in each jurisdiction.

More