Telescope launches Insights: AI-powered analysis across global assets

Telescope announces Insights, an AI-orchestrated analysis engine that answers the fundamental question every investor asks: “What is happening with my investment, and why?”

Information overload in modern markets

Managing investments today means drowning in information. Every position in your portfolio generates endless streams of news, price movements, earnings reports, and market commentary. Investors with busy lives don’t have time to research each holding individually, cross-reference global events, or synthesize how different developments interact across their portfolio.

The typical investor experience looks like this: you check your portfolio, notice a significant move, and fall into a search engine rabbit hole. You’re scanning multiple news sites, pulling up charts, reading earnings transcripts, and trying to piece together a coherent picture of what’s actually happening. This process repeats for every position you hold.

”Every investor has asked themselves ‘what’s going on with my position?’ and you enter the rabbit-hole of a search engine - looking for earnings, news flow and zooming into charts to find answers.” Luc Pettett, Founder & CEO.

Specialized intelligence for every asset

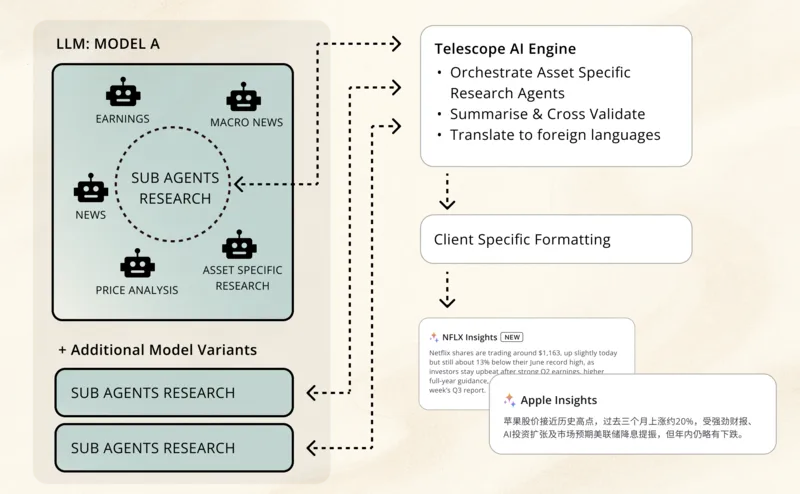

Insights deploys AI research agents that understand how different assets actually work. Each agent focuses on the specific factors that drive its asset class, gathering relevant information and filtering out noise.

Equities agents monitor earnings reports, product launches, management changes, competitive threats, and institutional positioning. They know a software company needs different analysis than a mining operation or pharmaceutical developer.

ETFs agents analyze underlying constituents and their relative weightings, understanding how geopolitical developments, currency movements, and country-specific dynamics affect the basket as a whole.

Commodities agents track supply chain dynamics, weather patterns, production decisions, and macro policy. They know gold responds to inflation expectations while oil reacts to OPEC decisions and seasonal demand.

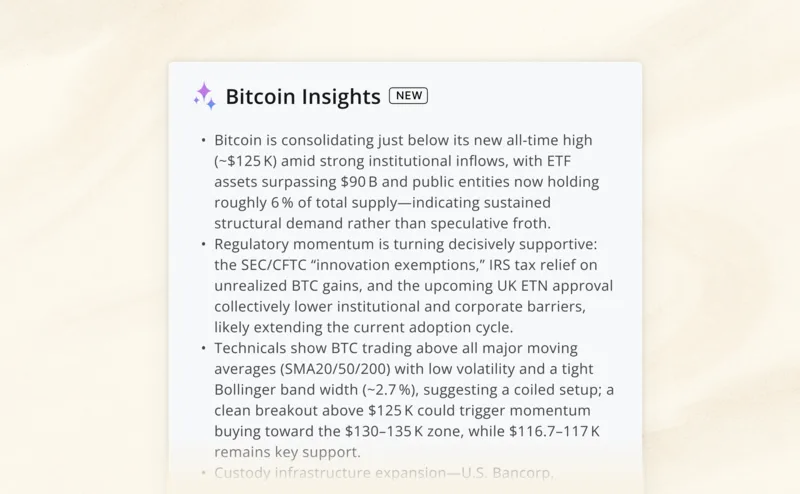

Cryptocurrencies agents follow regulatory developments, institutional adoption, network upgrades, and exchange flows. Bitcoin analysis focuses on ETF flows and macro conditions, while altcoins require tracking protocol updates and ecosystem growth.

These specialized agents know which data sources matter—SEC filings for equities, blockchain metrics for crypto, supply reports for commodities—and how to interpret changes in context.

How it works: Coordinated analysis

Insights orchestrates multiple AI agents across news archives, price histories, corporate filings, and analyst research. Each agent examines specific data sources, identifying relevant information and potential catalysts. The system cross-validates findings between agents to eliminate inconsistencies, then synthesizes everything into clear, simplified output.

The analysis adapts to different user needs. Long-term investors receive business fundamentals, competitive positioning, and macro trends affecting their holdings. Active traders get technical signals, momentum indicators, and short-term catalysts driving price action.

Insights delivers analysis in twelve major languages including Mandarin, French, Spanish, German, and Japanese, enabling global platforms to serve local markets without maintaining separate research infrastructure.

”Our partners asked for multilingual AI analysis capabilities, and we’ve delivered a global solution that’s flexible enough to serve any market” Laurene Mcmeckan, GTM

From individual insights to portfolio intelligence

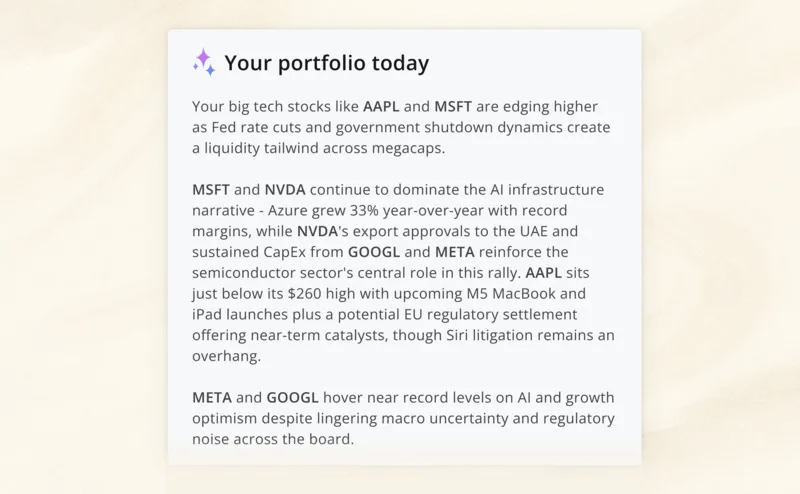

The real power emerges at the portfolio level. While single-asset analysis provides focused intelligence, investors need holistic understanding across all their holdings.

Insights aggregates individual asset analysis into portfolio-level summaries, highlighting the most significant developments across your entire portfolio at once. The system analyzes correlations between positions, identifies common themes affecting multiple assets, and surfaces the insights that matter most based on relevance and significance.

This transforms portfolio monitoring from a time-consuming research task into a single morning briefing that captures everything driving your returns.

Near-term development will incorporate position sizing into portfolio analysis, ensuring a 40% Bitcoin allocation receives proportionally more analytical weight than a 1% small-cap position.

”Insights solves a key problem investors face, and it’s remarkably simple. The end-user sees useful insights across single instruments, and their whole portfolio.” Dan Boneham, Product Advisor

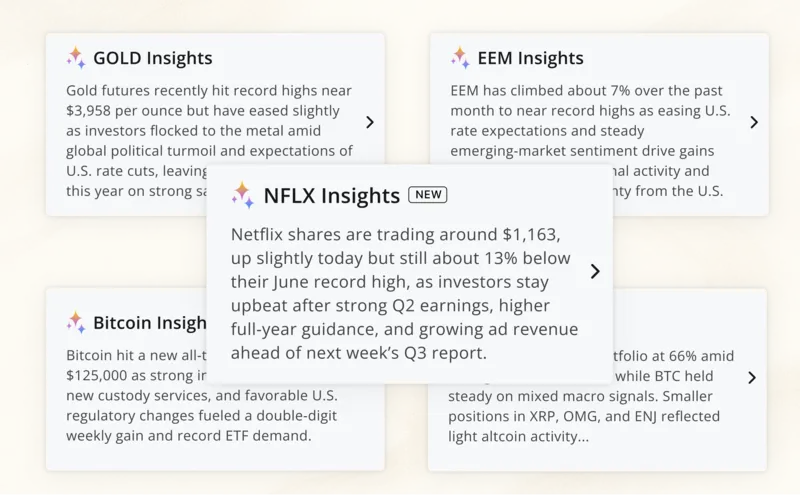

Sample outputs: Tailored to your audience

Retail investor view: Individual stock analysis synthesizes earnings data, institutional flows, product developments, and competitive positioning in accessible language.

Sophisticated trader view: Professional workflows require technical factors, momentum signals, and multi-timeframe analysis with deeper market context.

Enterprise integration

Insights integrates with broker platforms, wealth management systems, and fintech applications through Telescope’s API infrastructure, or bespoke whitelabel solutions.

The system supports customization for different user segments, languages or audience profiles, tailored to your needs.

For more information or to schedule a demo, contact sales@telescope.co.