Atlas update: direct advice and house views

When we introduced Atlas in October 2025, it was an API-first research platform focused on enterprise integrations. Since then, we’ve expanded Atlas in two new directions: a direct-to-consumer advisory interface and an environment framework that lets brokers and wealth managers encode their investment philosophy into the advice engine.

Atlas is a research and development project. It is not a licensed financial advice product and is not available for commercial deployment to end clients. Telescope is actively engaging with licensed financial services providers to explore regulatory pathways in each jurisdiction.

Direct-to-client advice flow

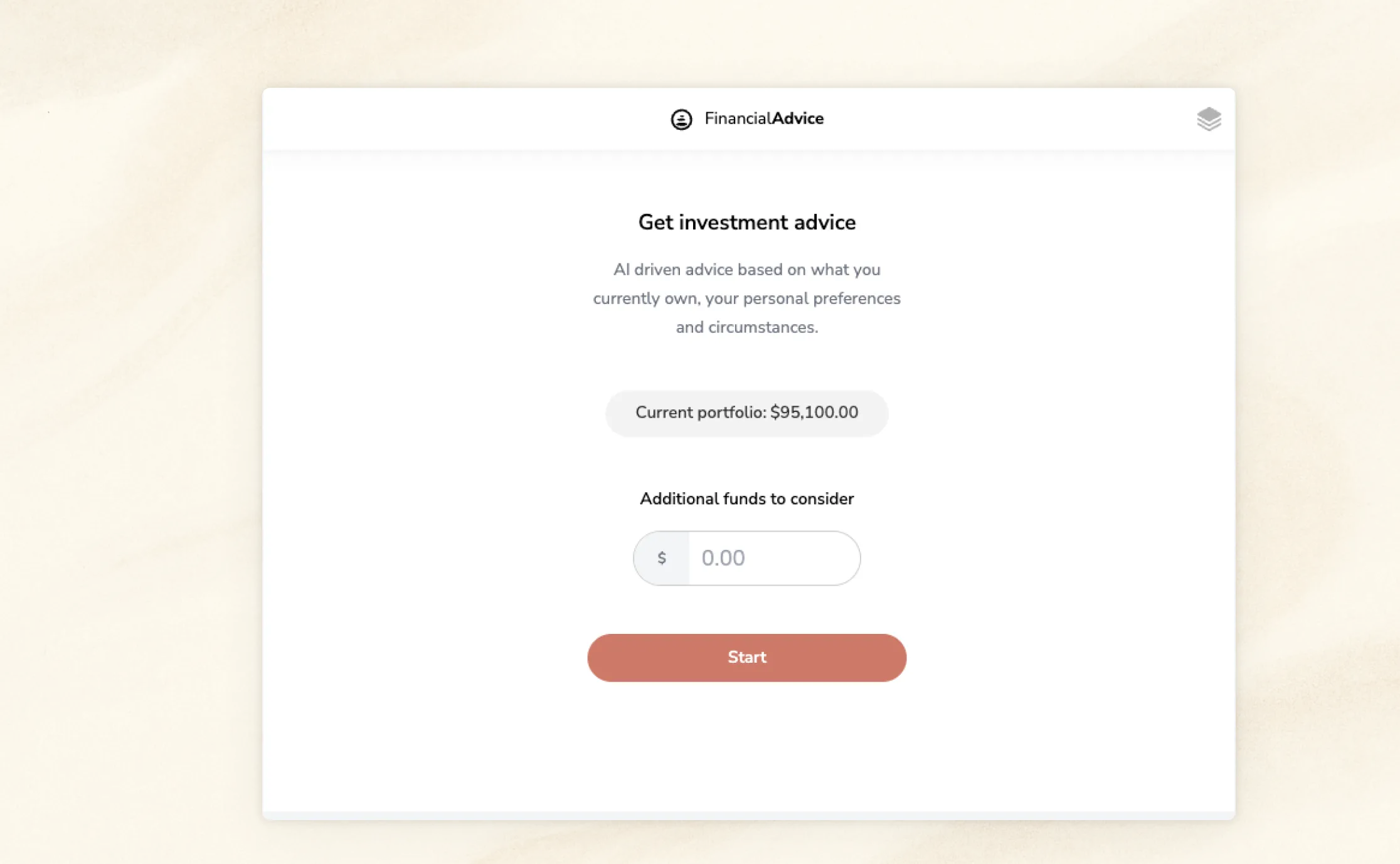

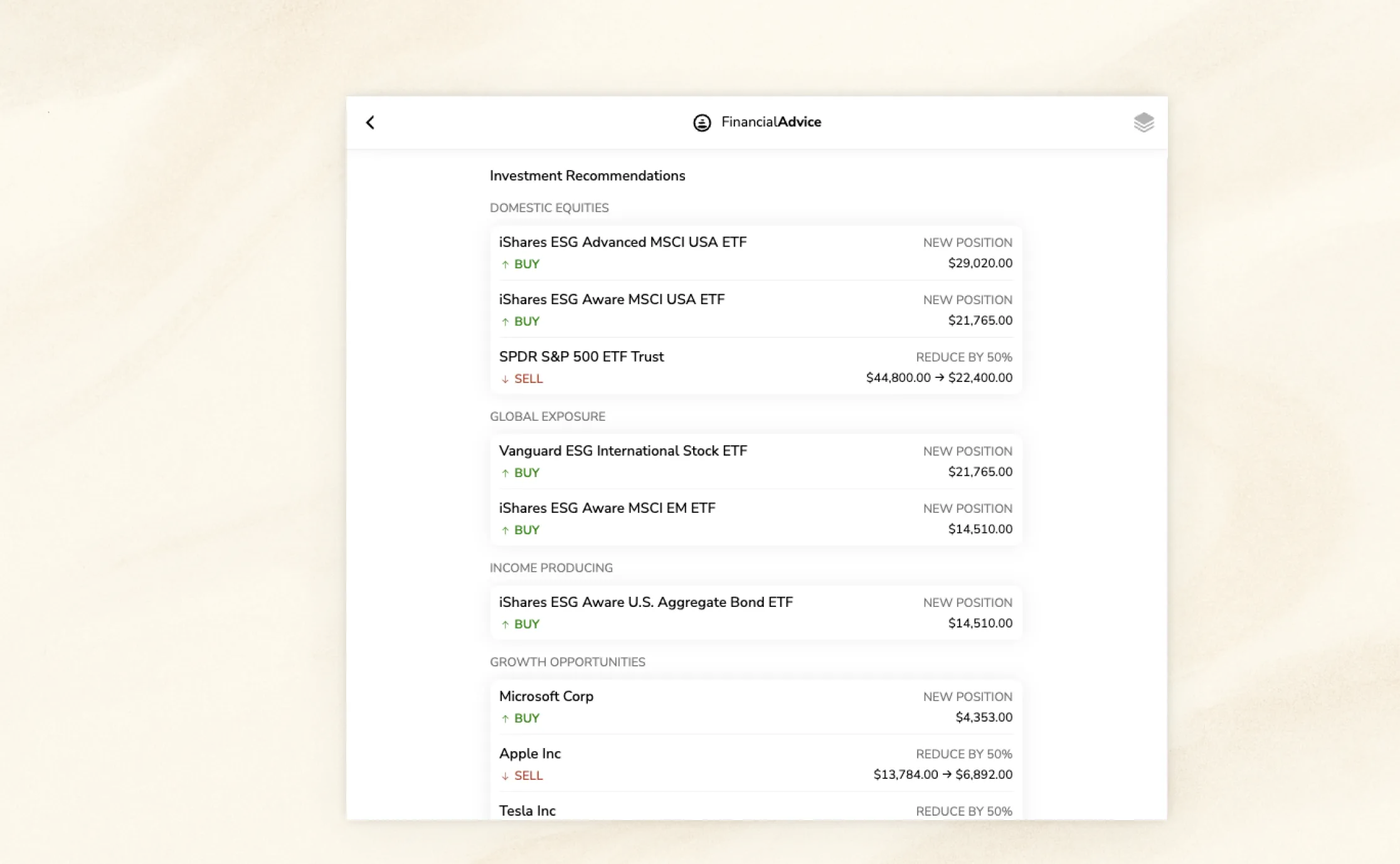

Atlas now supports a front-end advisory flow where an end client can receive personalised portfolio advice rather than go through an intermediary workflow. The client provides their details, confirms their understanding, and Atlas generates a full advice report, including a set of executable trades.

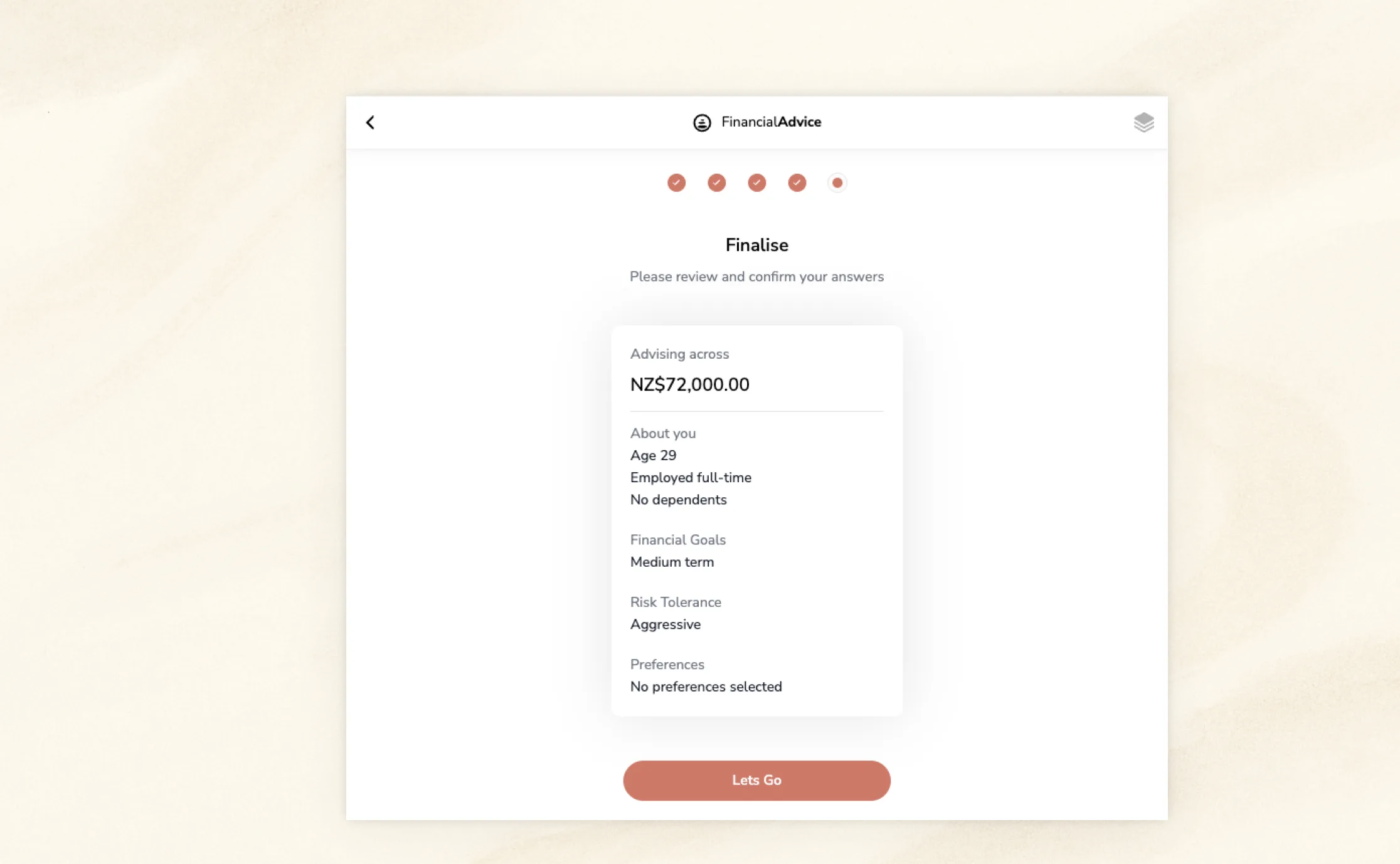

In practice, the flow works like this: a client enters their investable amount, their dependants and personal circumstances, their investment horizon, and their risk tolerance. Atlas then works through hundreds of reasoning steps across the client profile, firm environment, instrument selection, and portfolio construction before producing a recommendation.

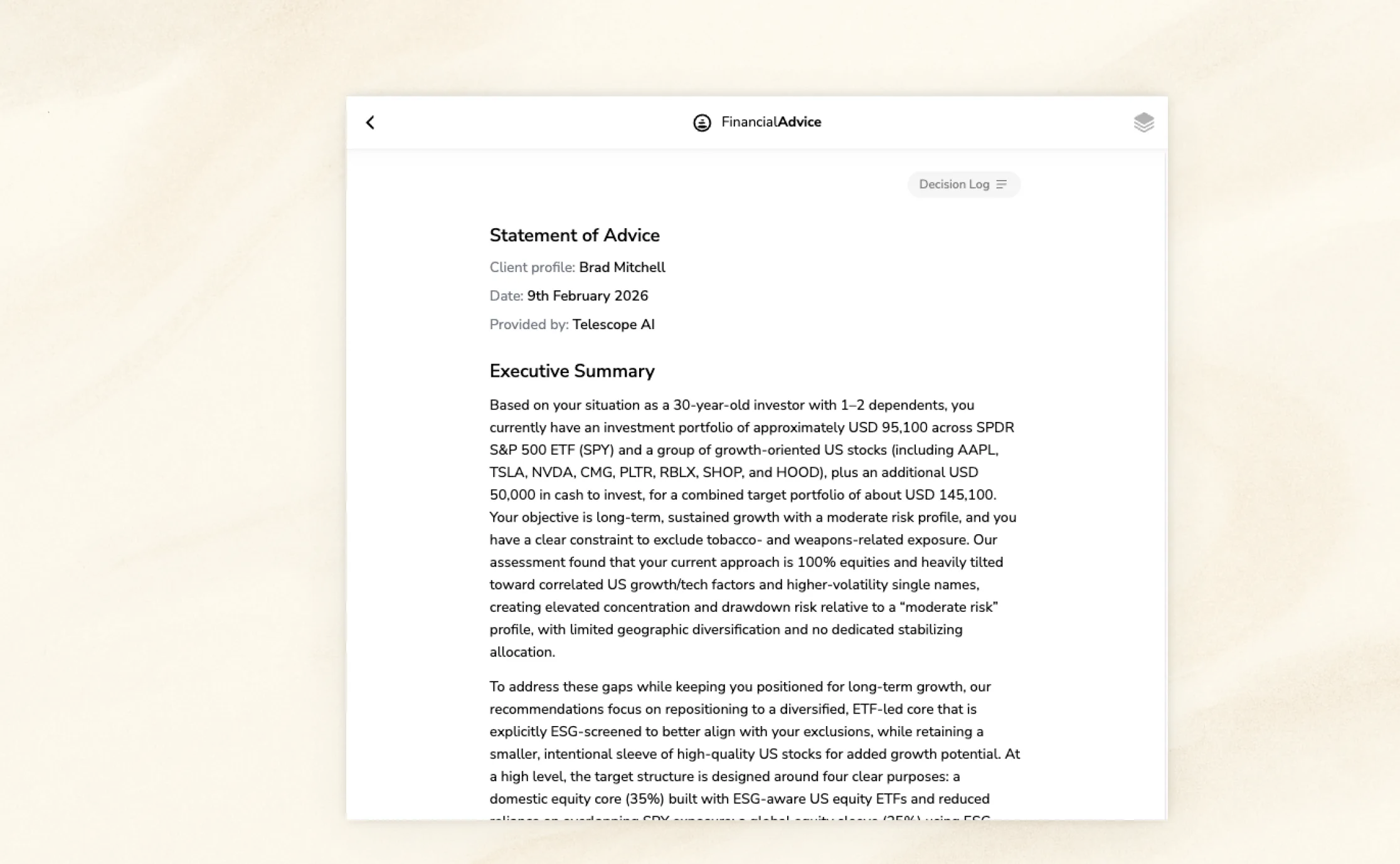

In a recent demonstration, Atlas generated a complete advice report for a client with $10,000 USD to invest, one child, a long-term horizon, and moderate risk tolerance. The process took approximately 11 minutes. The output included an assessment of the client’s existing positions, a recommended strategy, asset allocation across defined buckets, and a specific set of trades.

For a broker platform, this means the client could potentially review and implement the recommended trades in a single action. The advice report serves as a draft Statement of Advice, covering client circumstances, strategy rationale, portfolio construction, and the final trade list.

House views and environment configuration

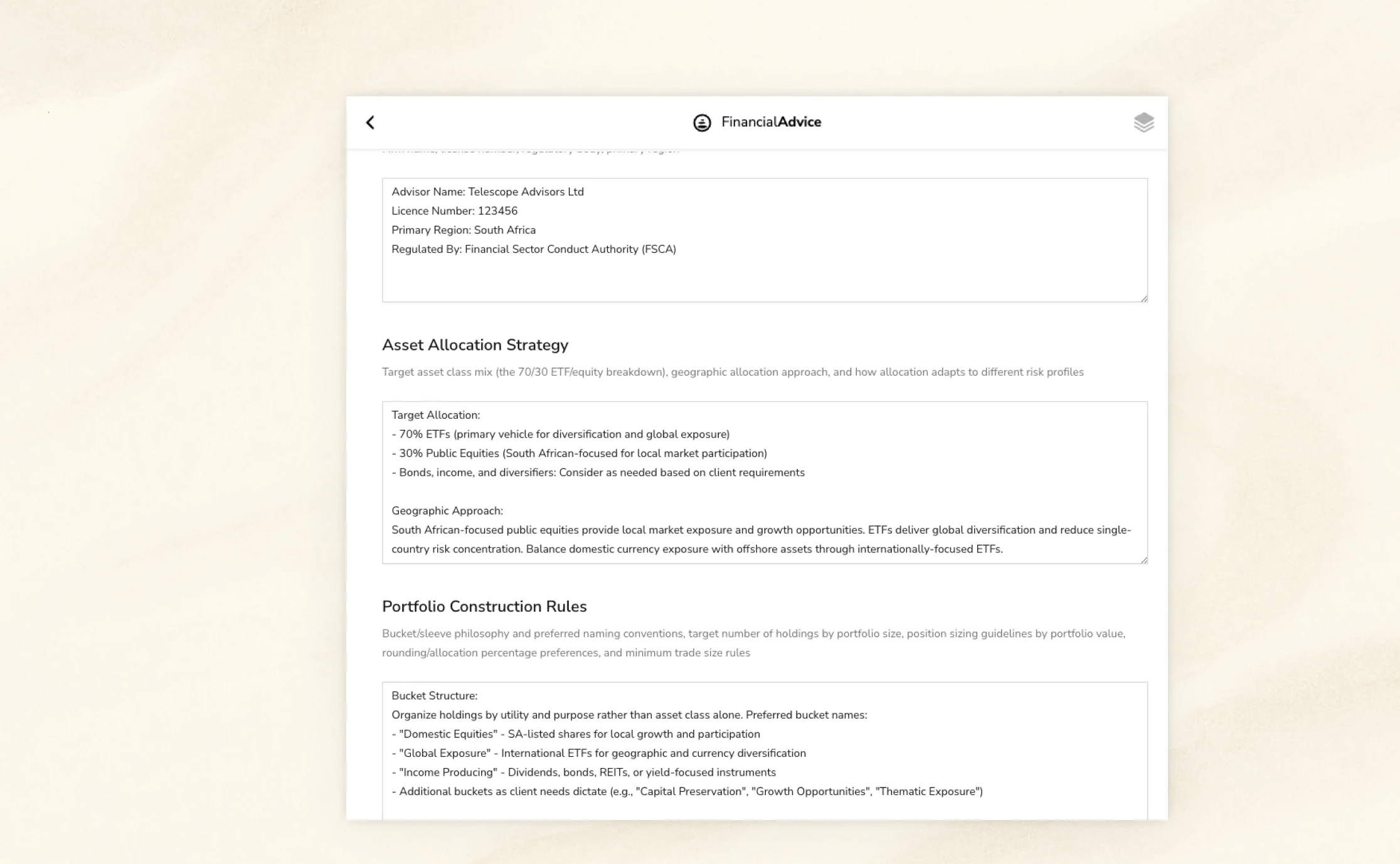

The biggest addition since launch is the environment framework. Brokers and wealth managers can now define their house view in detail, and Atlas will follow that philosophy at every stage of the advice process.

Firms configure four areas:

| Area | What it covers |

|---|---|

| Advisory context | Firm details, licensing/regulatory context, and region |

| Investment universe | Allowed exchanges, asset classes, and instrument groups |

| Portfolio rules | Target allocations, position sizing, holdings count, and trade constraints |

| Risk and governance | Suitability settings, house views, and special-case handling |

A New Zealand-focused environment, for instance, might specify NZX stocks and NZX ETFs as the available instrument groups, denominated in NZD, with a target allocation of 60% ETFs for diversification and global exposure and 40% domestic equities for local market participation. The portfolio construction rules might require 15 to 25 individual positions, allocations rounded to clean percentages (no figures like 66.66% or 14.28%), and minimum trade sizes of $10,000 to $15,000 to justify brokerage costs.

The environment also handles less obvious instructions. A wealth manager might specify that existing concentrated positions, whether company stock or inherited shares, should be assessed case by case rather than liquidated by default, factoring in tax implications and client attachment. Illiquid holdings like property and private equity can be acknowledged in the overall wealth picture but excluded from the liquid portfolio rebalancing calculation. Atlas references the full environment at every stage of reasoning. When it selects an instrument, constructs a bucket, or sizes a position, it works within the boundaries you’ve set.

How Atlas constructs a portfolio

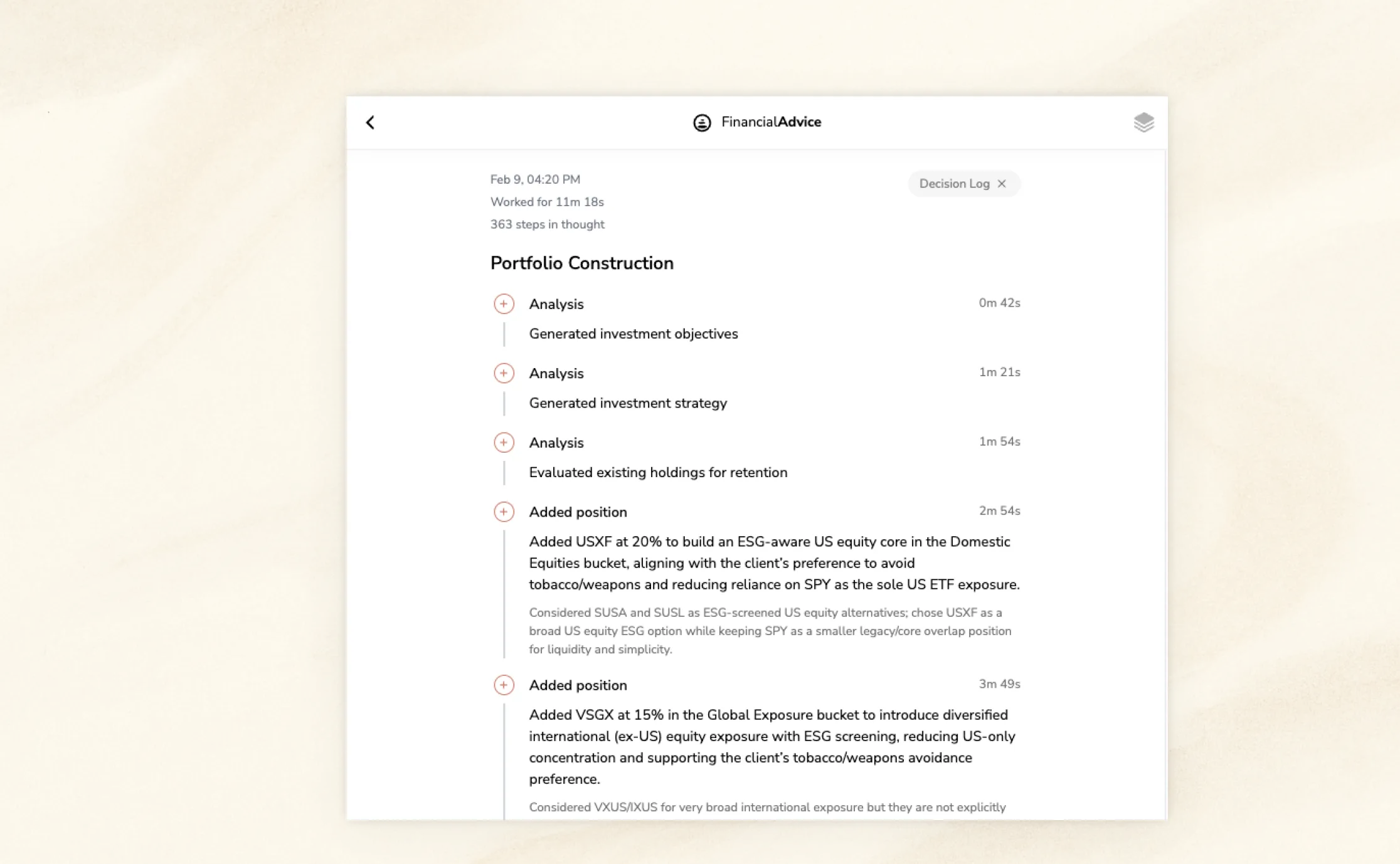

Atlas uses an iterative workflow, not a single model pass. In practice it:

- Reviews the client profile and any existing holdings

- Sets strategy and target allocations based on risk profile and house view

- Selects instruments from the allowed universe and drafts trades

- Checks for concentration, allocation drift, and rule breaches, then rebalances if needed

- Produces the advice report, including rationale, trade list, and decisions log

Most runs complete in 5 to 15 minutes, depending on client complexity and portfolio size.

Decisions log and transparency

Every instrument Atlas considers, selects, or rejects is recorded in the decisions log. For each position in the final portfolio, the log details what alternatives were evaluated and the reasoning behind the final choice.

This is deliberate. As regulators around the world evaluate AI in financial advice, being able to explain why a recommendation was made — not just what was recommended — will be a baseline requirement. Atlas produces this audit trail as a native output, not as an afterthought.

The case for agentic advice

In many markets today, Atlas cannot be licensed as a standalone financial advice provider. Most regulatory frameworks were written for human advisors and haven’t been updated for agentic systems.

This matters because traditional advice is still out of reach for most retail investors — cost and minimum portfolio thresholds keep them out. The people who most need personalised guidance are usually the least likely to get it.

Atlas is built to close that gap responsibly: it applies a consistent reasoning framework, produces a decisions log for explainability, and runs at a fraction of the delivery cost. It’s not a replacement for human advisors today, but it’s ready for structured testing with regulators, brokers and wealth managers.

Available for research and testing

Atlas is available now for licensed financial services firms who want to evaluate agentic advice in their regulatory context. We can configure an environment to match your house view, instrument coverage and compliance requirements, then generate test advice across a range of client profiles.

If you are a broker, wealth manager or regulatory body interested in exploring Atlas, contact our team at hello@telescope.co.