Introducing Atlas – AI powered financial advice

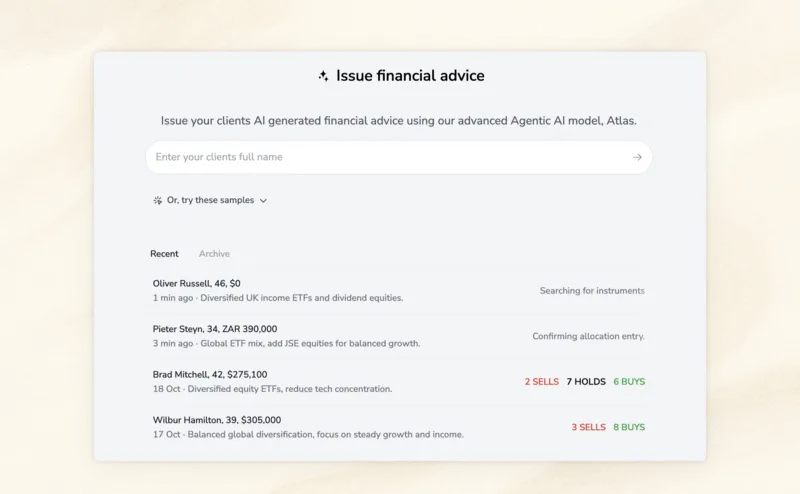

Today, we are excited to introduce Atlas, a groundbreaking agentic platform designed to generate financial advice across any major global market, in any language.

Atlas is a research and development project. It is not a licensed financial advice product and is not available for deployment to end clients. Telescope is working with licensed financial services providers globally to navigate regulatory pathways appropriate to each jurisdiction.

Atlas is being developed as an API and custom white-label deployment option that would enable enterprise platforms to deliver sophisticated, tailored financial advice. It constructs comprehensive portfolio recommendations in minutes, leveraging advanced reasoning and inference capabilities without relying on external data sources or APIs.

Out of the box, Atlas will be guided by your instrument coverage: global exchanges, domestic exchanges, ETFs, stocks, commodities, cryptocurrencies or any other major asset class.

The Agentic Advantage

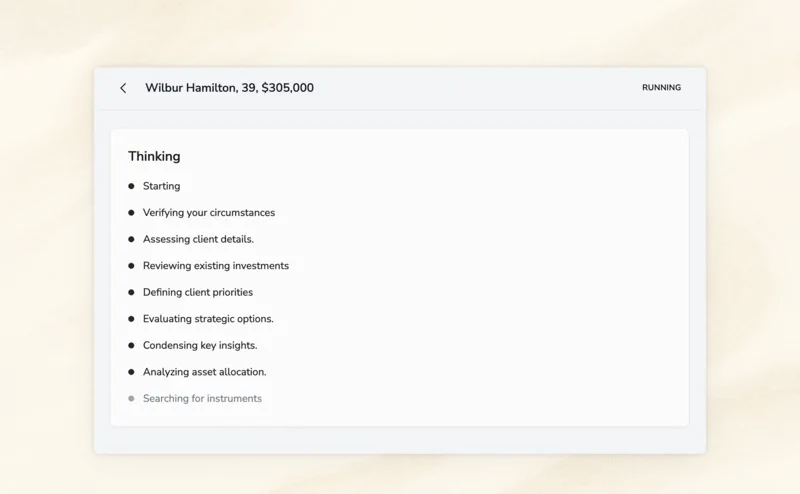

Unlike traditional portfolio construction methods, Atlas relies on an agentic workflow. It doesn’t just retrieve information or rely on model portfolio construction—it actively reasons to build a complete financial advice narrative. To generate a single set of recommendations, Atlas often performs over 600 individual ‘thinking’ steps, carefully analyzing constraints and preferences before arriving at a robust conclusion.

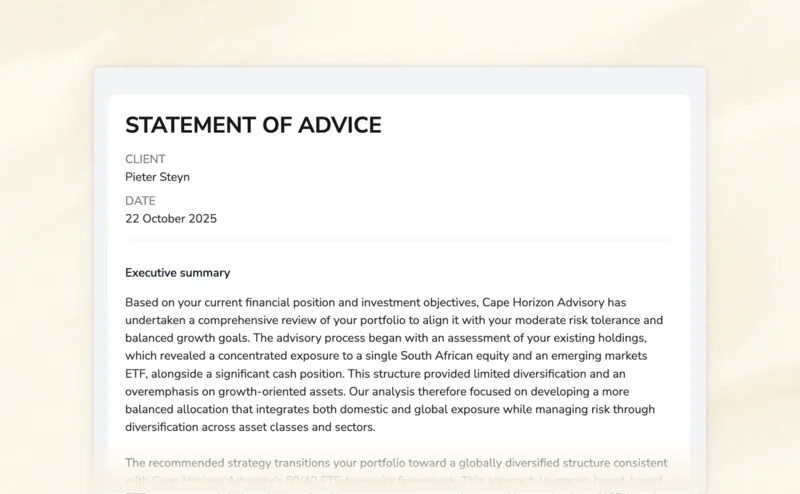

Atlas thinks through the same stages a human advisor would consider: client information, risks, existing portfolio, ideal strategy, portfolio construction, asset allocation and executive summary. At each stage, it conducts deep reasoning while maintaining best practice allocation principles. This process takes between 3 to 10 minutes, depending on the complexity of the client’s portfolio and the inputs provided. The result is a draft Statement of Advice (SOFA/SORA equivalent) tailored to the client’s unique circumstances.

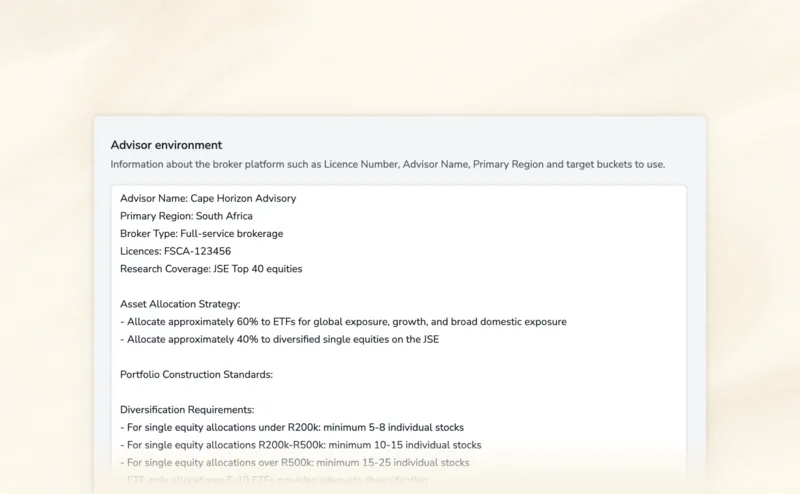

Advisor Environment

Atlas can operate across any major exchange, from the LSE and NYSE/NASDAQ to the ASX and New Zealand markets. You define the instruments and asset types available—equities, crypto, commodities—based on your coverage and expertise.

The environment configuration lets you establish your house view or buckets. For example, you might focus on REITs or commodity producers as key allocation categories. You can also set firm-specific rules such as “allocations should be rounded to the nearest $100k for portfolios over $5m” or “favour domestic ETFs for global allocation.” Atlas recalls your environment while running every stage of the allocation process, ensuring recommendations align with your operational standards.

Client-Specific Recommendations

Atlas generates recommendations based on the parameters you provide through your integration. This could be as simple as “$10,000 to invest, moderate risk, ETFs only” or as comprehensive as income, age, occupation, dependants, existing portfolio, and detailed financial circumstances. Atlas reasons within the bounds of the information supplied—it doesn’t fabricate missing data. The scope and depth of the advice scales naturally with the inputs: minimal parameters yield focused recommendations, while richer data enables more nuanced, personalized guidance. Atlas dynamically adjusts its reasoning based on the client’s risk tolerance, whether explicitly stated or inferred from the parameters your system provides.

The client receives a thorough draft report written on your behalf, detailing what we know about them, their circumstances, why the recommendation is suitable, and the portfolio of trades themselves.

Portfolio Construction

Atlas builds diversified portfolios that balance the client’s objectives with your defined constraints and instrument universe. Each allocation is reasoned through multiple stages, ensuring the final portfolio reflects both client needs and advisor guidelines.

Decisions Log

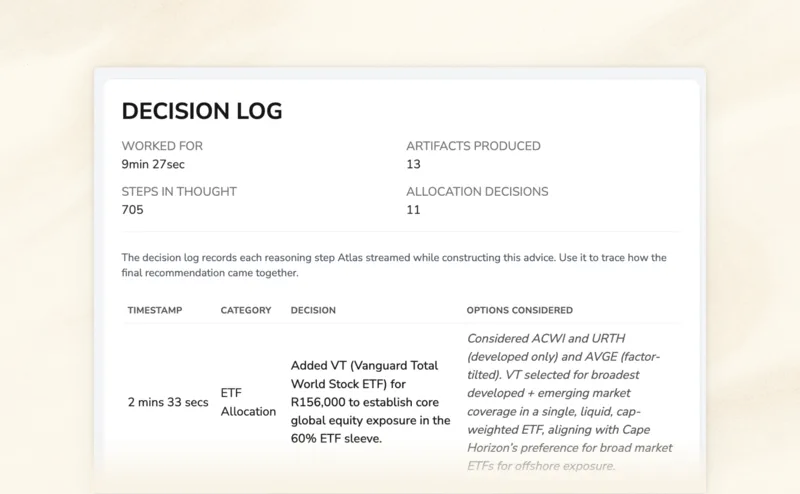

As regulators explore AI solutions for portfolio allocation, transparency around the decision-making process will be critical. We acknowledge that the ‘black box’ nature of AI systems is a valid concern.

Atlas has been designed to report any assumptions and decisions along the way. The decisions log details why an asset was chosen and what alternatives were considered at each stage. This provides a clear audit trail of the reasoning process, helping firms meet potential regulatory requirements for explainability and oversight.

Seeking Global Partners

Telescope is seeking licensed financial services partners globally who see value in AI-powered financial advice, within their regulatory environments. Whether you’re exploring how Atlas could augment existing advisory workflows, accelerate draft SOA preparation, or transform your platform’s capabilities, we’re eager to collaborate with forward-thinking firms willing to help navigate the regulatory and practical challenges of this technology.

Our long-term objective is to work with broker platforms to develop systems capable of constructing optimal portfolios based on whatever level of client detail is provided—from simple parameters like “$50k, conservative risk, global ETFs”, confined to a select series of appropriate model portfolios, to comprehensive data arrays including dependants, income streams, expenses, and debt levels. Atlas adapts its reasoning process to deliver appropriate recommendations regardless of input complexity.

To learn more about Atlas and explore partnership opportunities, contact our team at hello@telescope.co.